Google Keyword Planner| Helium 10 | JungleScout |vidIq |GTrends

Tag or leave a comment to promte others

DEbt

Analytics: http://bit.ly/2ZOMvrF

Messages: http://bit.ly/2QkHXpw

Payouts: http://bit.ly/2FehDHo

Pricing Discounts: http://bit.ly/2FgUUKL

Affiliate Marketing- WIX Website

Step 1

Step 2

Google Maps

Step 1

Step 2

$997-EASy how-TO-60 day money back

Google Keyword Planner| Helium 10 | JungleScout |Ecomhunt |

Chrome Apps: Turbo Ad Finder |

Shopify Dropshipping

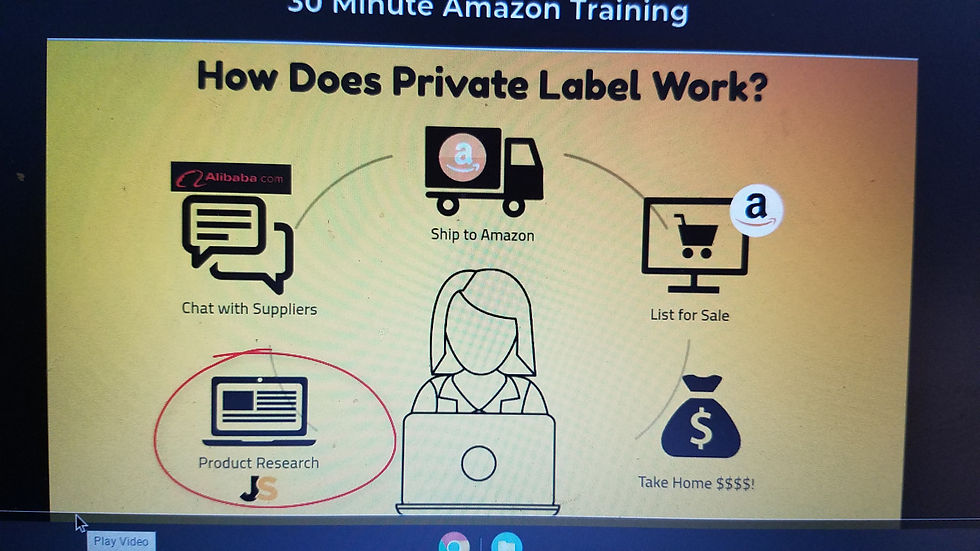

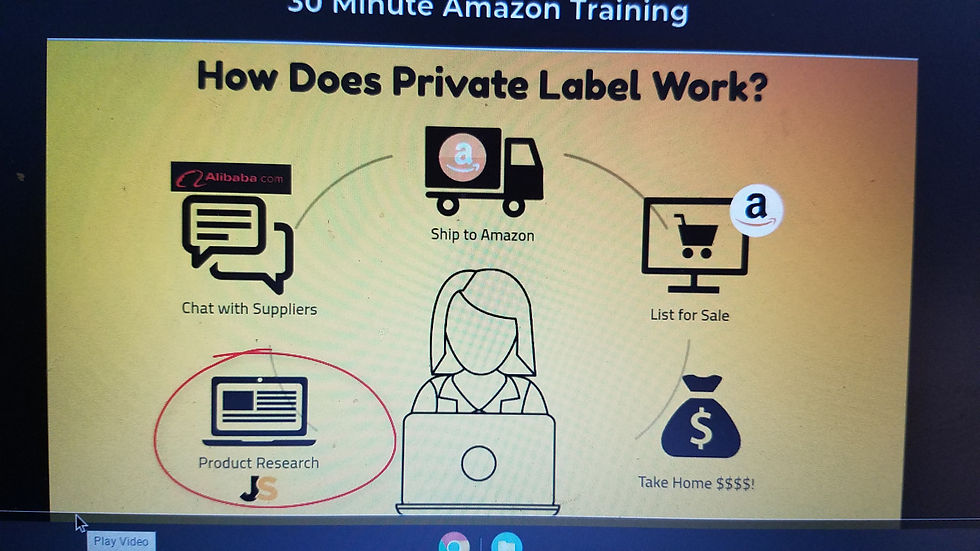

Amazon Private Label

YouTube Channel

Monetize-1K subscribers 4K hours watch time

ebay

MY SHELVES: https://amzn.to/2BLnUsI

MY BINS: https://amzn.to/2TY8mcj These bins hold 20-30 items each, depending on size, and the shelves hold exactly three per row (without the lid). We love them! ----------------------------------------------------------------------------------------------------

Tools I use: Goo Gone - https://amzn.to/2YwRLOx

Scotty Peelers - https://amzn.to/2LQEjDS

My Lights - https://amzn.to/2GABvFa Dymo 4XL

Thermal Printer - http://amzn.to/2ttOPq1

Dymo Address Labels - https://amzn.to/2X6YcYO Dymo 4x6

Shipping Labels - http://amzn.to/2ttjfsC Accutek

Small Shipping Scale - http://amzn.to/2ttHmaz

Large Shipping Scale - https://amzn.to/2LSNWSq

Polybags (for clothing etc) - https://amzn.to/38R1lBd

Polybags for Video Games - https://amzn.to/2QaMh9u

Bubble Wrap - https://amzn.to/2EfqEzV

Kraft Paper for Dunnage - https://amzn.to/2LPYTEq

Barcode USB Scanner - https://amzn.to/2uFocAU KDC200i

Scanner (try to buy this used!) - http://amzn.to/2sqBAXm

Label Sheets (if you don't have a thermal printer yet) - https://amzn.to/30reI7G

Polymailers - http://amzn.to/2ut7gbb

Packing tape - https://amzn.to/2QaukYv

Tape Gun - https://amzn.to/2YBZV8C

Sweater Shaver Lint Remover - https://amzn.to/2EdUvsl

Sewing Kit - https://amzn.to/2Qacbdb

Grandma's Magic Spot Remover - https://amzn.to/2VJyeh1

Dr Martens Wonder Basalm - https://amzn.to/2Gz0AjS

Allen Edmonds Shoe Products - https://www.allenedmonds.com/shoe-care/

Lysol Dual Action Wipes - https://amzn.to/2YxzHUy

Magic Erasers - https://amzn.to/2YzcAsB

Fluffy White Rug (not mine but similar) - https://amzn.to/2YyITbi

Background Photo Paper - https://amzn.to/2RzX6Uz

Bo Nash Powder - https://amzn.to/2HpWOLc

Saddle Soap - https://amzn.to/2YGrhKP

Suede & Nubuck Cleaning Kit - https://amzn.to/2wdOUy9

CD Cases (clear) - https://amzn.to/2YwWBLN

Plastic Wrap (for electronics) - https://amzn.to/2YzCP2o

Free USPS Shipping Supplies - https://store.usps.com/store/results/...

HUGE Ikea Duffel/Storage Bag - https://amzn.to/2Q8LbLj

Affiliate Program

ShareASale | RewardStyle | Amazon | CJ |

ShareASale | RewardStyle |

Selling Digital Courses

DIGITAL MKT-Blog site

https://marketing.sfgate.com/blog goog SITE!!!

1k

Index Funds

Gold

stock

Stocks

Yahoo- Support & Resistance

Mkt Watch - Performance

Google-Financial Performance

BusinessInsider-High/low

SeekingAlpha-Earnings Tab

StockCharts- SMA 50-200

MagicFormula-Stockscrener Min Mkt Cap 50 or 1000 & #Stock 30

FinViz-Screener tab Exchange-SP, Relative V 1, Avg Vol 500K>, Current Vol 500K> Price under ?

Pandemic-Proof Stocks

20 Stocks That Always Surge During Election Years

Determining how certain historical events impact the stock market is essentially impossible. There’s no way to separate one from another, and correlation is not causation. So if your desire is to simply identify the stocks that are surefire winners in an election year just by looking at past performance, you might be making a big mistake by assuming that consistent performance every four years is anything other than a coincidence. However, that doesn’t mean that trends are definitely not rooted in something you could apply to your own portfolio.

If you take the current list of companies in the S&P 500 and examine their performance in election years going back to 2000, you do have five different data points to look at. And there are five companies that have actually posted a gain in each of the last five election cycles. Here are those six companies along with their performance in each election year, as well as 14 other companies that have the largest cumulative gains over those five years in spite of at least one having a negative return.

Last updated: Sept. 22, 2020

PulteGroup (PHM)

-

2000 performance: 87.39%

-

2004 performance: 36.27%

-

2008 performance: 3.70%

-

2012 performance: 187.80%

-

2016 performance: 3.14%

How is 2020 looking for PulteGroup? Up 16.11%

W.R. Berkley Corporation (WRB)

-

2000 performance: 125.82%

-

2004 performance: 34.94%

-

2008 performance: 4.03%

-

2012 performance: 9.73%

-

2016 performance: 21.48%

How is 2020 looking for W.R. Berkley Corp.? Down 8.34%

Arthur J. Gallagher & Company (AJG)

-

2000 performance: 96.48%

-

2004 performance: 0.03%

-

2008 performance: 7.11%

-

2012 performance: 3.62%

-

2016 performance: 26.92%

How is 2020 looking for Arthur J. Gallagher & Company? Up 8.14%

Sherwin-Williams Company (SHW)

-

2000 performance: 25.29%

-

2004 performance: 28.47%

-

2008 performance: 2.95%

-

2012 performance: 72.31%

-

2016 performance: 3.52%

How is 2020 looking for Sherwin-Williams Company? Up 22.74%

Waste Management (WM)

-

2000 performance: 61.43%

-

2004 performance: 1.15%

-

2008 performance: 1.44%

-

2012 performance: 3.15%

-

2016 performance: 32.86%

How is 2020 looking for Waste Management? Up 2.73%

General Mills (GIS)

-

2000 performance: 24.61%

-

2004 performance: 9.76%

-

2008 performance: 6.60%

-

2012 performance: 0.02%

-

2016 performance: 7.13%

How is 2020 looking for General Mills? Up 10.19%

Find Out: How the Economy Is Doing in 30 Coronavirus Hot Spots

Quest Diagnostics Inc. (DGX)

-

2000 performance: 364.66%

-

2004 performance: 30.69%

-

2008 performance: -1.87%

-

2012 performance: 0.36%

-

2016 performance: 29.18%

How is 2020 looking for Quest Diagnostics Inc.? Up 6.37%

Laboratory Corporation of America Holdings (LH)

-

2000 performance: 377.22%

-

2004 performance: 34.83%

-

2008 performance: -14.72%

-

2012 performance: 0.76%

-

2016 performance: 3.83%

How is 2020 looking for Laboratory Corporation of America Holdings? Up 9.90%

Vertex Pharmaceutic (VRTX)

-

2000 performance: 308.57%

-

2004 performance: 2.13%

-

2008 performance: 30.78%

-

2012 performance: 26.17%

-

2016 performance: -41.45%

How is 2020 looking for Vertex Pharmaceutic? Up 21.88%

EOG Resources (EOG)

-

2000 performance: 211.39%

-

2004 performance: 54.59%

-

2008 performance: -25.41%

-

2012 performance: 22.61%

-

2016 performance: 42.82%

How is 2020 looking for EOG Resources? Down 53.93%

Regeneron Pharmaceuticals (REGN)

-

2000 performance: 176.63%

-

2004 performance: -37.39%

-

2008 performance: -23.98%

-

2012 performance: 208.62%

-

2016 performance: -32.38%

How is 2020 looking for Regeneron Pharmaceuticals? Up 54.44%

Monster Beverage (MNST)

-

2000 performance: -11.11%

-

2004 performance: 322.22%

-

2008 performance: -24.25%

-

2012 performance: 14.65%

-

2016 performance: -10.69%

How is 2020 looking for Monster Beverage? Up 30.83%

See: 50 Stocks That Have Suffered the Biggest Losses During the Coronavirus Scare

SBA Communications (SBAC)

-

2000 performance: 118.99%

-

2004 performance: 146.81%

-

2008 performance: -51.77%

-

2012 performance: 65.22%

-

2016 performance: -1.72%

How is 2020 looking for SBA Communications? Up 34.18%

Everest Re Group (RE)

-

2000 performance: 221.07%

-

2004 performance: 5.86%

-

2008 performance: -24.16%

-

2012 performance: 30.75%

-

2016 performance: 18.19%

How is 2020 looking for Everest Re Group? Down 25.55%

Teledyne Technologies Inc. (TDY)

-

2000 performance: 150.32%

-

2004 performance: 56.13%

-

2008 performance: -16.46%

-

2012 performance: 18.63%

-

2016 performance: 38.67%

How is 2020 looking for Teledyne Technologies Inc.? Down 7.79%

NVR Inc. (NVR)

-

2000 performance: 158.85%

-

2004 performance: 65.11%

-

2008 performance: -12.93%

-

2012 performance: 34.11%

-

2016 performance: 1.58%

How is 2020 looking for NVR Inc.? Up 5.58%

DaVita Healthcare Partners Inc. (DVA)

-

2000 performance: 156.05%

-

2004 performance: 52.08%

-

2008 performance: -12.03%

-

2012 performance: 45.79%

-

2016 performance: -7.90%

How is 2020 looking for DaVita Healthcare Partners Inc.? Up 19.74%

Nvidia Corp. (NVDA)

-

2000 performance: 39.64%

-

2004 performance: 52.13%

-

2008 performance: -76.28%

-

2012 performance: -11.54%

-

2016 performance: 223.85%

How is 2020 looking for Nvidia Corp.? Up 120.84%

Waters Corp. (WAT)

-

2000 performance: 215.09%

-

2004 performance: 41.10%

-

2008 performance: -53.65%

-

2012 performance: 17.65%

-

2016 performance: -0.14%

How is 2020 looking for Waters Corp.? Down 12.00%

Oneok Inc. (OKE)

-

2000 performance: 91.45%

-

2004 performance: 28.65%

-

2008 performance: -34.95%

-

2012 performance: -1.37%

-

2016 performance: 132.81%

How is 2020 looking for Oneok Inc.? Down 65.26%

Motley Fool Stock Advisor

$199 but $99 10/13/20

Oct 13

How To Invest $100,000 For $940 Per Month In Passive Income

OCtober 20, 2020 If you have $100,000 to invest, you can easily use it to unleash a dividend stream that pays you $940 a month. That’s $11,280 a year in dividends—on just $100K!

I know you’re probably thinking this sounds too good to be true (and you should be!), especially when 10-year Treasuries dribble out just 0.7%, and the typical S&P 500 stock isn’t much better, with a 1.7% yield.

You’re not retiring on either one of those meager payouts!

But $100,000 invested in a fund with an 11.3% dividend yield (like the one we’ll dive into below) gives you a good start toward clocking out, and on a modest nest egg, too.

The nice thing about this approach is that you’ll still invest in blue chip companies like Mastercard (MA), Deere & Co (DE) and PepsiCo (PEP). That’s the real magic of this strategy: it lets you take low payers like these (PepsiCo is the highest yielder of this trio, at 2.9%) and “squeeze” them for a far bigger payout. Here’s how it works:

Step 1: Open a Brokerage Account

This isn’t really a step for many people—if you’ve read this far, you probably already have a trading account. No matter what kind of account it is, you’re fine to use it (so long as it lets you trade US stocks, of course): there’s nothing exotic about the funds we’re going to target with this strategy. They trade on the major markets, just like stocks.

If you don’t have $100K in your account already, go ahead and transfer it in.

Step 2: Buy a Closed-End Fund

Next, you’ll need to purchase a closed-end fund (CEF). The name we’re targeting today is the Gabelli Equity Trust (GAB). Let’s get into a little more detail on both CEFs in general and GAB in particular.

First, a CEF is like a mutual fund or an exchange-traded fund (ETF), but with some key differences. Unlike mutual funds, whose values are reconciled and unit prices are set after each trading day, CEFs trade during the exchange’s opening hours, just like an ETF or a regular stock.

And unlike ETFs, a CEF has a fixed amount of shares that are established when the fund holds its IPO. While ETFs can, and do, increase their total number of shares outstanding, CEFs do not, which helps keep them small and more manageable. An ETF like the SPDR S&P 500 ETF (SPY) can balloon to have a whopping $278 billion in it, where the biggest CEF has just $4 billion in assets. GAB is much smaller, with $1.3 billion.

GAB is managed by a group of value investors who focus on high-quality, mostly mid-cap and large-cap stocks. This team is headlined by famed value-investing guru (and Warren Buffett disciple) Mario Gabelli. Mario and his team look for companies with reliable cash flow and rising profits, which is why the fund owns Mastercard and PepsiCo.

Unlike ETFs, which usually pay tiny dividends, GAB (like most CEFs) focuses on maximizing dividends to shareholders; it does this by collecting payouts from the companies it holds and rotating assets and occasionally taking profits, which it then gives to shareholders in the form of dividends. That’s one way the fund can sustain a double-digit dividend.

There’s another part to the fund’s strategy, too: a careful use of leverage—by borrowing to invest, Gabelli and his team can enhance their portfolio’s returns, boosting its profits (and your payouts) further. Leverage, of course, also amplifies losses, a risk Gabelli mitigates by targeting companies trading below their intrinsic value and by keeping his leverage manageable—right now, the team has borrowed against roughly 25% of the portfolio.

Leverage is a particularly smart strategy today, with the cost of borrowing essentially at zero.

Now let’s take an exploded view of our GAB investment, so we can see exactly what we’ve got on the line here, and how much we’re getting back in dividend cash:

Step 3: Wait Two Months

After we’ve bought our shares, the last part is the easiest: just wait for the checks to roll in.

GAB pays dividends every three months, with the next payout coming sometime around December 14. That means in about two months, an investor who puts $100K in now will have $2,830.05 in time for Christmas.

If you want to set this up as a recurring income stream, all you have to do is set an automatic-payment-transfer from your brokerage account to your bank account for $943.35 every month, and GAB’s dividends will appear in your account—in cash.

Google Adsense

Passion Product

Product Research

1. A Good idea a. Write down ideas b. Make a list of interest c. Check Amazon Activity - Check what you search for in Amazon. Anytime you search something on Amazon and you can't find it, that is a great sign. d. Tools in Success pack.

2. Validate your Idea You want to make sure this product is something people would buy and you can validate it by using the following tools:

a. You can look up similar products on Amazon and see how well those products are doing.

b. You can also use the free version of Jungle Scout to look up for similar products.

c. Google Keyword Planner to see if people are searching for this kind of product

d. Google trends to see if this is something that is growing or dying.

e. Launch Group. This is the most important tool that you can use to validate your product. It can be a Facebook Group where you can start growing by adding family and friends. You can then connect it to your Instagram account and document your journey to give updates to people in your launch group.

Ask for feedback and opinion from them and at the end, they will support your product when you launch it because they've helped to create this product. -

Launch your product as a KickStarter to test it our first, Key Secret to Making a Great Product - Premium - Viral - Consumable - Good Margins - You Would Buy it - Easy to Ship - Upwards Trending

Options

Visit our site - https://skyviewtrading.com

Passive Income Dividends

Real Estate

https://www.thanmerrill.com/

https://www.fortunebuilders.com/real-estate-investing-strategies/

FortuneBuilders 3-Day Workshop: Than Merrill's Real Estate Class .....If you’d like to learn how to invest in real estate, you have until midnight to get these 116 courses for free …

21 Modern Kitchen Ideas To Spruce Up Your Space

23 Gray and White Bathrooms That Are Chic, Cozy, and Calming

Before and After: The 10 Best Kitchen Redos We Saw in 2020

Inspiring Design And Decor Ideas With Floating Shelves

The 30 Best Bathroom Makeovers We’ve Ever Seen

Upgrade Your Home With 11 Smart Outlets That Will Make Your Life Easie

The best smart Christmas trees for 2020

he 20 Best Bedroom Makeovers We’ve Ever Seen

Before and After: The 10 Best Living Room Redos We Saw in 2020

The 20 Best Kitchen Makeovers We’ve Ever Seen

DIGITAL MKT-Social Media

Once filming is complete, you’ll need to edit your video to give it a quality look. Fortunately, editing is no longer limited to film experts. One tool that I’ve found to be particularly helpful is VideoBoost, a free app in the BoostApps suite that offers easy-to-use templates and animations that can integrate with your business’s logo, as well as trimming and formatting for various social platforms and helpful editing filters. You can add your own video and text or use stock footage and pre-written copy.

You should also be mindful of how different social media platforms can influence your video formatting. For example, Instagram videos have a maximum length of 60 seconds, and most users prefer a square 1:1 aspect ratio that matches the style of photos found in their feed. With Facebook, on the other hand, you can post videos as long as 120 minutes (not that that’s recommended). Landscape video in a 16:9 ratio is preferred. Don’t let the wrong formatting throw off your marketing efforts.

FIVERR